It has now been 3 months for me working as a freelancer. Not a lot of time for an experienced solopreneur – but felt like a roller coaster for me 😉. One reason for me to leave the corporate world was to stretch myself, to learn, to leave my comfort zone – and yes, I guess this part works well so far. I recently wrote down some lessons for myself, helps me to internalize things and make sure I don’t forget them. And on second thought, might as well share some here for the wider community.

Here is the first one that I thankfully discovered before it had an impact on me – and it is related to everyone’s favorite topic: taxes. The unfortunate truth for small businesses in Germany is that 30%-50% of your revenues – are not yours, they belong to the tax authorities – who will come and claim them eventually. How much exactly I will explain in this article – and also have created a small tool that helps me with the calculation.

The VAT Trap

Now that I have managed to scare away everyone with this nice announcement, what exactly is the trap I am talking about? Well, theoretically, things in Germany are not that hard with regards to taxes for small businesses like mine. When I write a bill to a German customer, it includes value added tax (VAT). We are in the business-to-business space, so both my customer and myself can claim the VAT back from the tax-authorities – no problem. However, what does feel strange for someone like me with an employee history is: the VAT from the customer ends up on my bank-account first, the customer pays it to me. However – this is NOT my money, I owe it to the financial authorities – who will claim it from me sooner or later.

The Income Tax Surprise

There is a second part to this trap. Also from the money that is left over after deducting the VAT – the financial authorities want another piece – my income tax. As a freelancer, the income tax I need to pay is based on my revenue minus all operating expenses = operating profit. From the operating profit, the “normal” income tax rates are deducted in the usual progressive way. As an employee, you don’t need to worry about this, all of this is handled by your employer when he pays you your salary – you can see the income tax on your pay slip, you can be sad that it is a lot of money every month – but you cannot make mistakes around it, as your employer pays it to the authorities directly for you. In Germany, the income tax rate starts at 0% for very low incomes – and goes up to 45%. Which is a lot – especially if (like me) – you don’t start at 0%, because you have still earned a bit of salary and annual bonus in the same year from your previous employer.

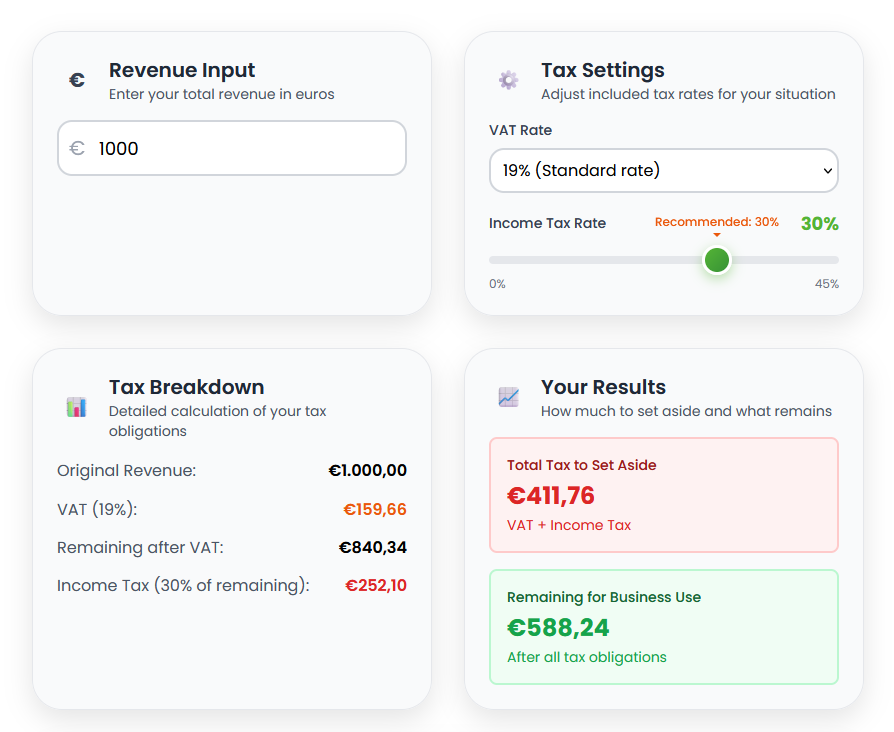

At this point – maybe an example is in order from a small tool that I created to spare me from calculating all of this manually. From 1000€ revenue that ends up in your bank account as a small business owner – only 588€ or even less (depending on your income tax rate) – is for you to spend!

Try the tax-calculator yourself with your numbers, if you like!

When the Bill Comes Due

All of this is something you need to be aware of and handle yourself as a business owner – the financial authorities will eventually come and claim their money – and at this point the trap closes. Let’s say (like me) you start your own business in June this year. The first time I need to declare my income / taxes will be beginning of next year. The authorities will take some time for the calculation, so let’s say 9 months after I have started my business – I can expect a nice claim from the tax authorities – for the full amount. And they will not only expect me to pay the taxes ASAP – but they will also do a forward-calculation and now ask me to pay my taxes quarterly based on my previous earnings. So another hit into my company bank account that will be coming then.

If at this point, I will have earned some money, spent it for my business or to cover my living expenses (remember: it is in my company bank account – it looks like it is mine to spend!) – and have not put aside anything – it will most likely bankrupt my business. And this is what is happening to many small companies at this stage.

A Simple Solution

The solution is also simple – and luckily, I have watched enough tax-related YouTube-content when I started my own business to know it: create a sub-account with your bank – and whenever money comes in from your customer – put a fraction of it aside. How much to put aside depends on your specific situation – and I got sick of typing the formula into my calculator, so I created a small tool that does the calculation for me. Or actually: Claude Code did most of the coding, while I focused on prompting, user experience and error-correction 😉.

To summarize the learning: a substantial amount of the money that ends up in your bank account as a freelancer is NOT your money, it belongs to the tax authorities. Put their share aside regularly whenever a payment from a customer comes in onto a separate sub-account, which you don’t ever touch – except to pay the tax-authorities when they want their value added tax or income tax. Use a tool like this one to help with the calculation – and resist the temptation to spend this money in any other way. It is easy – once you have gotten used to the fact that you need to now manage those things yourself, rather than having an employer handle it for you.

Good luck with your own business – and if you found this helpful:

- Try the tax calculator

- Share this lesson with fellow freelancers and small business owners just starting out

- Follow me on LinkedIn for more lessons learned

Disclaimer

It should be self-evident from the way this article is written – but I am certainly NOT a tax advisor – so treat all of this as lesson learned and definitely NOT as sound tax advice from an expert on the topic. If you need that and advice for your specific situation, consult a tax advisor! And secondly, this advice is applicable for you if you have a sole proprietorship (“Personengesellschaft” in German) – NOT for corporations (“Kapitalgesellschaften”) – where other rules apply!